Charlie Munger: the wise investor

Charlie Munger was one of the most respected and admired investors in the world.

His professional and personal career is full of lessons of wisdom, both in the financial and human spheres.

In this article, we will review some aspects of his biography, his investment philosophy and his advice for living better.

|

| Charlie Munger: the wise investor |

Who is Charlie Munger?

Charles Thomas Munger was born on January 1, 1924 in Omaha, Nebraska, the same city where his friend and partner Warren Buffett was born. He died on November 28, 2023 at age 99.

From a young age he showed a great interest in learning and reading, and graduated in mathematics from the University of Michigan. After serving in the Army during World War II, he entered the prestigious Harvard University to study law, without having a prior degree.

After finishing his studies, he moved to California, where he practiced as a real estate attorney. However, he soon discovered his passion for investments and founded his own investment company, which brought him annual returns of 20%. In 1978, he joined Berkshire Hathaway, the business conglomerate led by Buffett, as vice president and right-hand man to the Oracle of Omaha.

Munger has been key to Berkshire Hathaway's success, providing his strategic vision, analytical rigor and multidisciplinary mentality. Additionally, he has chaired other companies such as Wesco Financial Corporation and Daily Journal Corporation, and has been a director of Costco Wholesale Corporation. He has also been noted for his philanthropic work, donating millions of dollars to various educational, scientific and social causes.

|

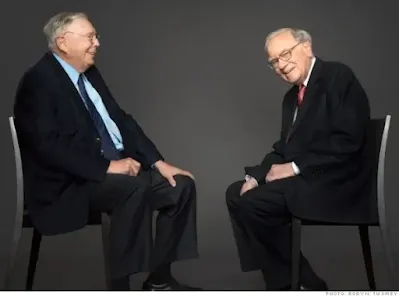

| Charlie Munger (left) and Warren Buffett |

What is your investment philosophy?

Munger is a faithful follower of value investing, a school of thought that seeks to buy shares of companies that are undervalued by the market, but that have great long-term potential. However, Munger has introduced some variations on the classic style of value investing, which has also influenced Buffett.

Munger prefers to buy quality companies, with sustainable competitive advantages, good management teams and high returns on capital. You're willing to pay a reasonable price for these companies, rather than looking for bargains among cheaper stocks. As he says: "It is better to buy a wonderful company at a fair price than a fair company at a wonderful price."

Another distinctive characteristic of Munger is his preference for concentration over diversification. Munger believes that excessive diversification can reduce returns and reflect a lack of conviction or knowledge about investments. For this reason, he usually invests in a few companies, but very well selected and studied. As he says: "The great advantage of having fewer bets is that you can pay more attention to each one."

Munger has also distinguished himself for his multidisciplinary and holistic approach when analyzing investments. Munger believes that it is necessary to have extensive knowledge of various disciplines, such as psychology, economics, history or philosophy, to better understand how the world works and make better decisions. As he says: "You have to have a network of mental ideas from several important disciplines and use them all."

What advice do you give us to live better?

Munger is not only a great investor, but also a great thinker and a great communicator. His public interventions are full of humor, irony and practical wisdom. Munger offers us numerous tips to improve our personal and professional lives, based on his own experience and common sense.

One of his most important pieces of advice is to be constant learners. Munger encourages us to read widely, to study various topics and to maintain a curious and humble attitude towards knowledge. As he says: "In my entire life, I have never met a wise person who didn't read all the time. None, zero."

Another of his most valuable tips is to avoid big mistakes. Munger warns us about the dangers of falling into psychological traps that make us act irrationally or counterproductively. As he says: "You don't have to do extraordinary things to achieve extraordinary results. You have to avoid stupidity, especially avoidable stupidity."

A third piece of advice that Munger gives us is to be ethical and honest. Munger reminds us that integrity is essential to long-term success and to earning the respect and trust of others. As he says: "Reputation is very hard to get and very easy to lose. You have to be very careful with it."

Conclusion

Charlie Munger is an example of a wise investor, who has known how to combine his financial talent with his humanistic vision. His biography, his investment philosophy and his advice for living better are a source of inspiration and learning for all of us. As he says: "The best thing you can do for yourself is to try to improve your own character."

Comments

Post a Comment